About:

If you are looking for help relating to USA Taxes then you're on the right place.

I am an experienced tax preparer and specialist in US-based Income Taxes and e-filing. I can help you with all of your corporate tax-related matters. I have expertise in individual resident and non-resident taxation and personal businesses (LLC). I have been helping businesses and individuals for accounting and tax preparation, bookkeeping, tax planning, tax return preparation and filing over the past 4 years.

I can prepare and file your business tax or personal federal and state tax returns promptly and accurately. I am available year-round to help you with tax returns amendments, extension or any question.

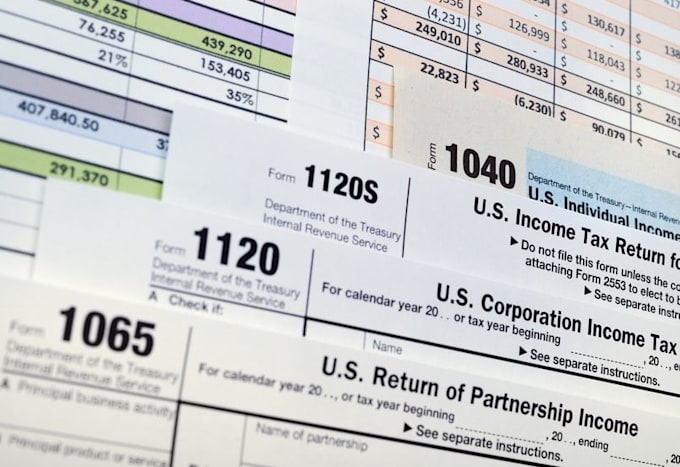

- Individual Tax Return 1040

- Business Tax Return 1120-S (S Corporation)

- Business Tax Return 1120 (C Corporation)

- Business Tax Return 1065 (Partnership)

Please note, an LLC can be taxed on the individual level or as a Corporate level, or Partnership depending on how it was originally set-up.

Bookkeeping must be up to date through the last day of the business' tax year, otherwise I will have complete it before preparing your taxes.

Reviews

:

ABSOLUTELY THE WORST COMMUNICATION EVER HORRIBLE his taxes are questionable. He would tell me he'll do it in 1 hour & 1 hour turned into one week he said it was because of his sick dad but he did the same thing over & over again NO excuse could never get in touch with him Not even cust serv.

:Very bad experience. Buyer was requesting unnecessary revisions without having basic knowledge of the process, she was not willing to pay extra for the that additional work.

:Wasiq answered my questions and executed the job exactly as I'd hoped. I feel very comfortable with the finished documentation and would definitely hire Wasiq again.

:Excellent job!

:Returning customer here. Wasiiq is a highly qualified professional with outstanding customer service.

No comments:

Post a Comment